Robinhood: Men in Headbands

You either die a hero, or live long enough to see yourself become the villain.

As a child growing up in the 90s, Robin Hood: Men In Tights was one of my favourite movies (now looking back as an adult, I realise how inappropriate it is for a kid - what were my parents thinking?!). It was the classic tale of the legendary outlaw who stole from the rich to give to the poor…but full of stereotypes, crude humour, and Dad-joke level puns.

And I loved it.

In one of the scenes, Robin is initially defeated in an archery tournament.

"I lost?" he says, completely bewildered. "But I'm not supposed to lose. Let me see the [movie] script."

He then pulls out a leather-bound stack of papers, flips through the pages of the script, and discovers that the screen-writers have given him an extra shot.

In response to this, the two villains in the movie (Prince John and the Sheriff) exchange an alarmed look, before comically pulling out their copies of the movie script and flicking through towards the end to scan the lines.

"Yes, he does, he does," they mutter in unison, rolling their eyes at each other in resentment.

Naturally, Robin wins the tournament with his final, script-approved shot.

If only life were that easy for our modern day Robinhood. I'm sure they're hoping there's something written in the script that lets them have that final run at making things right.

The man in the headband

Robinhood, a commission-free stock trading and investment app launched in 2015 to great acclaim. Targeting millennials with its promise of democratising the stock market, it was notorious for its easy-to-use, gamified UI (think falling confetti when wins were made 🎊), which allowed the average person to purchase shares (or better yet, tiny portions of shares) without any fees or account minimum requirements.

With 13 million users, it was lauded in the media as the financial equaliser of the average Joe...until recently, when it went from being the people's champion to the stock whipping boy, all within the span of a few days.

It all began last week, when users of the subreddit community r/WallStreetBets encouraged each other to purchase shares in Gamestop, a brick-and-mortar chain store that sells video games. A man named Keith Gill (otherwise known as DeepF***ingValue - the guy wearing a headband that you might have seen on the Internet lately) had purchased shares in the company last July, and was regularly posting about it on Reddit.

Gamestop - which was reportedly struggling financially and had plans to close around 450 stores this year - went from a share price of around $4 last year to suddenly surging to a high of $483 per share.

The motivation behind the purchase of Gamestop shares appears to be two-fold. The first was that it became known that certain hedge funds (including Melvin Capital) had shorted the stock (i.e. bet against it). If you want a simple explanation of shorting, check out this brilliant (and funny) thread:

The news that hedge funds were shorting Gamestop spurred on Redditors. As one analyst described it:

[Redditors had a] "peculiar vigilante morality...They seem hell-bent on taking on Wall Street, they seem to hate hedge funds and threads are peppered with insults about 'boomer' money."

This doesn't quite explain why it was that Gamestop in particular was the focus of the Reddit traders. In fact, what started with Gamestop then spread to other companies such as Blackberry, AMC, and Nokia. In retrospect, it seems that these stocks were picked for nostalgic reasons: if you think about the demographic that knows and once cared about these companies, you'd probably be able to narrow it down to those in their late 20s to mid 30s (like me).

Precisely the demographic of people that used Robinhood (their average user is 31 years old).

The world’s tiniest violins

With Gamestop's share price surging to unthinkable levels, hedge funds who had shorted the stock suddenly found themselves in the awkward position of trying to decide whether to buy back the shares at a significantly higher price - and therefore, at a serious loss. Melvin Capital exited its short position after raising additional funds (including a whopping $2.75 billion injection from two other firms), resulting in a 53% loss in January.

The money Melvin Capital received from other firms reinforced the narrative that the rich were bailing out the rich. Combined with complaints from some hedge funds about how Redditors were engaging in stock price manipulation, it was not long before the memes began to appear on social media.

As Redditors cheered and congratulated themselves on forcing hedge funds’ hands (likening to the battle as David vs Goliath) and reminding each other to "hold the line" (i.e. don't sell the shares), the drama was about to take another turn...

You either die a hero, or live long enough to see yourself become the villain.

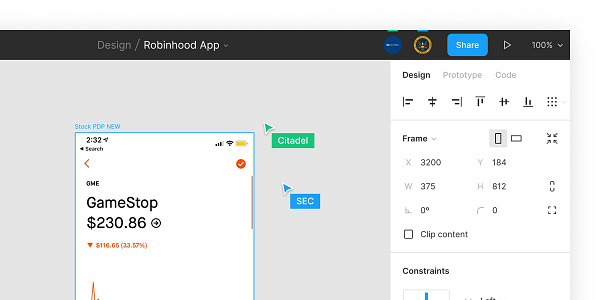

Robinhood, the app that had once said "we believe that everyone should have access to the financial markets", decided to stop allowing the purchase of shares in Gamestop (and other companies like AMC and Nokia - plus cryptocurrency Dogecoin) last Thursday.

Bizarrely, the platform was initially tight-lipped on why they chose to limit trading in these stocks, citing only "recent volatility".

This did not sit well with its users, who quickly took to social media to denounce the app. The rumour that the app was deliberately shutting out the average person in order to buy precious time for the big guys to reposition, quickly turned into a full-blown conspiracy about how Robinhood had been pressured by firms like Melvin Capital or Citadel to turn against the little people.

In response, Robinhood CEO Vlad Tenev went on CNN for damage control.

Unfortunately, he wasn't very convincing (in fact, one online spectator called it an "absolute roasting"). He reiterated on multiple occasions that Robinhood was the "spokesperson of the individual investor", "enabling and empowering the customer", and that "we will 100% protect our customers". What was once a rallying cry that appealed to the average person sounded like a worn-out, almost hypocritical, banality.

Having listened to the interview though, I thought the main problem was that Tenev continued to refer ambiguously to "financial requirements" and "SEC requirements", without giving specifics. When CNN host Cuomo pressed him as to whether it was a liquidity issue because they couldn't meet capital requirements, Tenev quickly turned to mention deposit, capital and operational requirements - without any details. He didn't even march out the usual corporate spiel of "The company has been advised by its legal counsel that we must take this course of action...", which is something I've seen used many times by corporate leadership to (often effectively) reduce decision-making scrutiny.

Similarly, Robinhood's social media and blog posts simply referred to "market volatility" as the reason why certain share purchases were suspended, fuelling further speculation.

Although such restrictions were eased the following day (with traders permitted to buy and hold small numbers of stock), the damage was done. Robinhood's Google Play store rating took a dive down to 1 star until Google removed around 125,000 negative reviews (citing “coordinated or inorganic reviews"). Since then, more negative reviews have appeared, tanking Robinhood's app rating back down to 1.1 stars, and Google apparently has no interest in removing these latest ones.

In addition, the hashtag #DeleteRobinhood began to trend, with users decrying the platform on Twitter and advising each other of other alternatives to transfer their business to.

It wasn't until Friday that Robinhood went on the front-foot with clearer explanations as to their rationale. In a post on their website, and through emails to customers, they admitted that the amount required by their clearinghouse to cover the settlement period of some securities rose: "with individual volatile securities accounting for hundreds of millions of dollars in deposit requirements—that we had to take steps to limit buying in those volatile securities to ensure we could comfortably meet our requirements." In other words, Robinhood was required by its clearinghouse to have a certain amount of money on hand when people purchase stocks (in order to cover its risk profile) - and it simply didn't have those funds during the recent market volatility.

“To be clear, this was a risk-management decision, and was not made on the direction of the market makers we route to,” the company said.

Here’s the thing: I believe them. I don't think there is a conspiracy between the hedge funds and Robinhood to stop individual investors from getting into the market. Robinhood ended up having to pump around a billion dollars into the fund, and then raise $US2.4 billion from shareholders, in order to meet its clearinghouse deposit requirements (their clearinghouse, NSCC, had originally asked for a US$3 billion guarantee due to the stock volatility, but later reduced this to $700 million).

Stick it to the man

Despite Robinhood's (albeit slightly delayed) efforts to explain their actions, users were still livid - and even worse, mistrustful.

What is interesting to note is that when the Gamestop incident hit social media, lots of people were creating great tweet threads, TikToks etc explaining short selling (like the brilliant coat-borrowing thread I posted at the start of this newsletter). This consumer-created educational content showed clearly what short selling was, and why the short sellers were getting screwed over.

When Robinhood came out to explain why it was that they had to limit certain share purchases, no one cared. No one was creating content explaining or justifying the economics of their decision.

The damage was done, and people were no longer on their side.

And this leads me to the final point of this newsletter...

I see lots of startups talk about how they are making a positive change in the world. "Democratising finance!", "letting you into the property market in spite of the boomers!", "stopping insurance companies from ripping you off!", "taking back control of your data from the data vampires!" their landing pages scream. That's all well and good. However, in this day and age, when memes and anger spread like wildfire (and often far faster than logic and critical thinking), be careful about your messaging.

Other brokers like Interactive Brokers and Webull also restricted trading in GME and other shares, yet there was almost no mention of their actions in the media.

Any time you position yourself as a Messiah, or as fighting for the little guy against the boomers/Government/big corporates etc, you inevitably put yourself on a pedestal.

If you can stay up there, good for you - but it’s a long fall from the top if things go awry.

For Robinhood CEO, Vlad Tenev - who had previously said that individuals not having access to the markets “ultimately contributed to the sort of the massive inequalities that we’re seeing in society" - it was a long fall indeed.

x Carmen (@carmenhchung)

PS. I spent days writing this article 🥺. If you enjoy this newsletter, I would love it if you’d consider sharing it with others who might also appreciate it.

My recommendations this week

🦻For those who don’t understand why people believe in conspiracy theories:A Conspiracy Theory Is Proved Wrong by The Daily. “She lives on the Upper East side of Manhattan, she’s a middle aged white woman, went to Harvard…[She said] ‘I don’t want to talk to people who think I’m crazy, and I don’t have the support network that some people do. I am my own support network…I am not talking to anyone right now, and that is my choice’.”

📰 For those who find themselves saying “I told you so!” all the time to their friends: Why we need to be right by Ness Labs. “From a very young age, children are taught the benefits of being right. Our education system is established on the paradigm of right and wrong. Answers deemed to be correct are rewarded; wrong answers result in lower grades, which supposedly lead to a less successful life. As a student, getting the right answer quickly becomes the primary goal. This mental model gets so deeply ingrained, we keep on carrying it in adulthood.”

🐦 For those who are still not sure about the difference between Reddit user DeepF**ingValue and Robinhood CEO Vlad Tenev: